Should I Invest In 401k Or Roth IRA?

Many young investors have this exact question – Should I Invest In a 401k Or Roth IRA?I’m talking about a specific situation where someone already invested in the 401k enough to get company matching. After that, should you invest further in 401(k) or Roth IRA?

I think most people who consider investing assume that they should invest in Roth IRA because the investment will never be taxed again. Choosing the best pension plan is never easy, however the tax advantage of the 401k plan is still substantial even with no company matching.

Let’s use an excel sheet to calculate which one is better for an average investor.

Here are some assumptions.

- The investor is in the 25% tax bracket. He can invest $5,000 in Roth IRA or $6,666 pre tax in 401k.

- 8% annual gain

- Investor retires at 60 and lives until 80. (A bit depressing.)

- Withdrawal rate is (total money left / years left to live.)

- After retirement, his income is derived solely from this portfolio, thus he has lower tax rate. This is a big assumption, but mostly valid. Most retirees make less money after they retire and pay less tax annually.

Here is the graph of the 401(k) vs Roth IRA.

As we expected the 401(k) portfolio grew much more than the Roth IRA because you start out with more money invested. The 401(k) portfolio grew to $815,558 at age 60 and the Roth IRA $611,668.

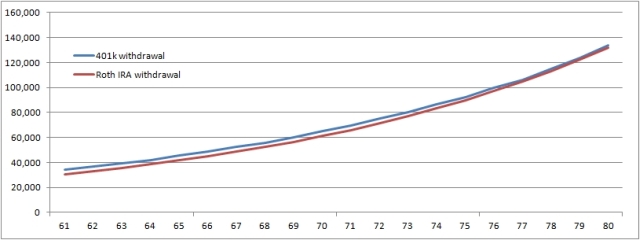

We need to zoom into the withdrawal period to see the differences between the two. This graph shows the income after tax.

The 401(k) plan has a bit of advantage here due to the lower tax rate after retirement.

At age 61, the 401k investor withdraws $40,778 from the 401(k) and receives $34,457 after tax. Assuming today’s tax rate, the investor pays about 15.5% tax on this income.

Withdrawal formula (total value of portfolio/years left to live) = ($815,558/20) = $40,778.

The Roth IRA investor withdraws $30,583 and keeps the whole amount.

We can see that if you invest in 401(k), you’ll have more retirement income even after tax. $4,000 might not seem like a large amount, but it is over 10% difference in income. In fact, the retiree will enjoy a total of $63,000 extra by investing in the 401(k) instead of the Roth IRA.

Of course, we made some assumptions above and the biggest one is that the tax rate will be lower after the investor retires. If the tax rate goes up in the future, then it maybe better to invest in the Roth IRA. I don’t think this will be true for me so I will continue to put the 401(k) first.

What do you think? Is it better to pay tax now and invest in Roth IRA or wait to pay tax after you retire? Personally, I think it’s better to max out the 401(k) first and then invest in Roth IRA. It’s best to max out both 401(k) and Roth IRA so you can take advantage of both programs. What do you do currently?

If you don’t have a Roth IRA account, you should open one to give yourself the more options in the future. Open an E*TRADE Roth IRA. No Fees. No minimums and get up to $600 when you rollover or transfer.

You can read more about traditional 401(k) vs Roth 401(k) as well.

No comments:

Post a Comment