Why the gold bubble will soon BURST!

While many analysts have forecast that gold prices will eventually hit $3,000 an ounce, after hitting a record $1,800 per ounce last week, economic experts at Kansas State University have warned that it is only a matter of time before the bubble bursts.

The huge federal deficit and a deteriorating economy have made many investors fearful of the US economy entering a period of stagnation, driving stock prices downward, said Lloyd Thomas, an economics professor at Kansas State University.

In this period of uncertainty, many are selling stocks and corporate bonds and putting their money into gold.

Click on NEXT for more...

Why the gold bubble will soon burst!

Recently, gold prices skyrocketed to as high as $1,800 an ounce and Thomas said the price might continue to creep higher as economic concerns grow.

"People believe that gold is a hedge against uncertain times," he said.

"In the long run, gold prices have kept pace with inflation. People are flocking to it," he added.

"But in 2000, the price of gold was $300 an ounce. It has gone up six-fold since then and it might go up higher than what it is right now. It's gone up too fast -- it's a bubble," he claimed.

Click on NEXT for more...

Why the gold bubble will soon burst!

Thomas compared his gold prediction to the housing market.

"People were lulled into thinking housing prices could never fall, but they fell more than 30 per cent in most American cities. The same thing could happen to gold; it's not risk-free," he said.

"In the last 10 years it's gone up 17 per cent a year, but the price of things we purchase has only gone up 3 per cent a year. That's unsustainable. It's my own opinion that gold prices will collapse -- I just don't know when," Thomas said.

Click on NEXT for more...

Why the gold bubble will soon burst!

Other financial experts agreed with Thomas' prediction of a further rise in the near term, citing a perceived security in tangible investments during uncertain times.

Ann Coulson, an instructor for Kansas State University's personal financial planning programme, said that the weakened US dollar and real estate market, the "wild ride" of the stock market and low interest rates have caused many investors to turn to gold.

"Where to invest has become a question for many and gold has risen to the top for some investors," Coulson said.

Click on NEXT for more...

Why the gold bubble will soon burst!

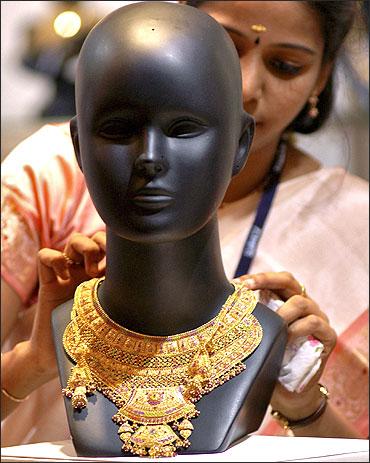

Coulson said there are many ways individuals may choose to invest in gold, including jewellery, coins, bullion or gold bars, exchange traded funds, gold mining stocks, gold mutual funds and gold futures and options.

Jewellery and coins are typically not good choices, she said, adding that gold bars raise many storage and cost issues.

Exchange-traded funds give the investor the opportunity to own gold without actual delivery and gold mining stocks' value is only partially dependent on the value of gold.

Click on NEXT for more...

Why the gold bubble will soon burst!

Diversified investments -- like gold mutual funds -- often offer the most protection, Coulson said.

"Gold futures and options are not for the novice investor," she said.

"Investing in gold through an infomercial on late-night TV is also a bad idea," she added.

Both Coulson and Thomas agreed that the price of gold may continue to rise, but cautioned that the increase most likely will not last.

From 1960 to the present, Thomas said, gold prices have gone up by an average of 8 per cent a year, while inflation rose at less than 4 per cent a year.

However, in the last 10 years, gold prices have gone up by 17 per cent a year.

Click on NEXT for more...

Why the gold bubble will soon burst!

Although the price of gold is high, it may be a good investment as the price continues to climb -- for now.

Unlike investing in stocks or bonds, Coulson said, there is no income associated with gold.

Money is made from buying low and selling high.

She agreed that the price is destined to fall at some point.

"Gold as a piece of a diversified portfolio might make sense, but if an investor invests solely in gold, that is a great risk," she said.

Click on NEXT for more...

Why the gold bubble will soon burst!

"It is not a safe investment unless you are buying gold bars and burying them in your backyard and even that is not safe, because the price is dictated by what buyers are willing to pay for gold," she added.

Thomas suggested that the only way to make a gold investment virtually risk-free is to look at it as a long-term investment, since in the long run, gold prices do tend to go up.

As a 50-year investment, gold may be a safe bet, he said, but it is not a guarantee in the short-term.

"On a 100-year horizon, sure -- buy gold and leave it to your grandchildren," he said.

Click on NEXT for more...

Why the gold bubble will soon burst!

"But in two, five or 10 years, prices could be lower than they are now. There's a lot of fluctuation. Prices have gone from $200 an ounce to $1,800. That just can't continue," Thomas said.

As the federal government attempts to pay interest on its growing debt, Thomas said the chance of increased inflation will go up.

As this happens, gold prices may continue to fluctuate as investors pull money out of stocks.

Click on NEXT for more...

Why the gold bubble will soon burst!

However, as the deficit slowly decreases, gold prices could fall by 50 per cent.

"When investors become more confident in the economy, gold will be less valuable as an investment," Coulson said.

"I agree with Warren Buffett: gold has no utility, so as a long-term investment, it's not a good choice," she said.

No comments:

Post a Comment