As you can see from this first one to the right, the beneficiaries aren't exactly hoi polloi. Nearly half the extra income from low rates go not to the top one percent but to the top one-tenth of one percent. That is hoi oligoi in anyone's book, except for the propagandists who try to convince people there was no such thing as class war until society's whiners and lazybones launched it. The top one percent of taxpayers receives 71 percent of all capital gains, according to the Tax Policy Center.

The preferential rate for capital gains is a key reason why the tax system violates the “Buffett rule,” which essentially states that high-income taxpayers should not pay [a lower percentage] of their incomes in federal taxes than middle-income Americans. A significant group of high-income taxpayers—particularly those who derive the bulk of their income from capital investments—pay taxes at a lower rate than many middle-class families.That isn't good enough for some people, like the face-palmers at the Cato Institute, who think the proper capital gains tax rate should be zero.As this chart shows, households with incomes between $50,000 and $75,000 who receive most of their income from their paychecks (as middle-class people generally do) paid 14.9 percent of their income in federal income and payroll taxes in 2011, according to [the Tax Policy Center]. Millionaires who received more than two-thirds of their income from capital gains and qualified dividends faced a 12.0 percent rate.

In the fear, uncertainty and doubt division of the capital gains department, the propagandists who object to any proposals for higher capital gains rates and/or seek lower ones than now exist—have a special target: seniors. They argue that raising capital gains taxes would hurt older people who are more likely than the young to have dividend and capital gains income. But, as CBPP points out once again, the distribution of tax benefits from the already-low capital gains rate is "highly concentrated among a small group of high-income households." As can be seen from the chart, the impact on seniors of raising the capital gains rates would affect a tiny percentage of the elderly. And they could easily afford the nibble.

Nearly 60 percent of elderly filers had incomes below $40,000 in 2011. As the chart shows, taxing capital gains and dividends at the same rates as salary and wages would have reduced their after-tax incomes by much less than one-tenth of 1 percent, on average, or less than $6.The CBPP site includes seven more charts focusing on the truth and myths of capital gains. The whole post is a nicely condensed collection whose arguments you can pull out during barbecue today when your right-wing uncle gets started jabbering about the damn socialistic scheme to alter the tax code. The way the current arrangement works, as in so much else, is socialism for the rich.Nearly all elderly households (96 percent) had incomes below $200,000 in 2011, and taxing capital gains and dividends at the same rates as salary and wages would have reduced their after-tax incomes by less than 1 percent, on average.

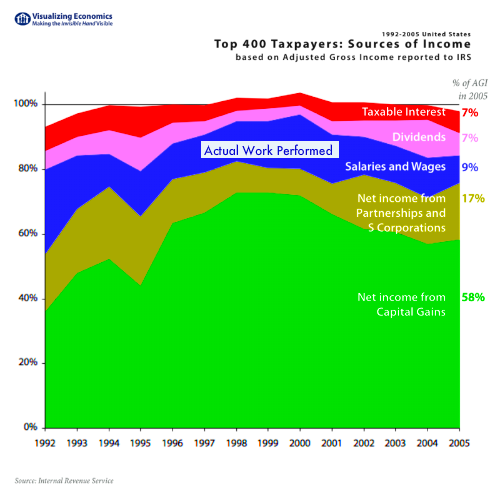

Everything but the dark blue is concentrating wealth based on "money attracts money." What is making it much much worse for the nation, its economy, and the American people is that most of this concentrating wealth is taxed at the very lowest capital gains rate -- if at all.

No comments:

Post a Comment